Designing feelings into financial services

In a previous post we explained how financial services have an uneasy relationship with the emotions that drive people’s financial behaviour. We are often advised to put our emotions aside when making financial decisions, but behavioural research shows that this is impossible.

Interestingly, while the financial industry claims that emotions should be ignored, financial service providers have been taking account of their customers’ emotions for centuries. For example:

The debt sector has long used emotional coercion to prompt loan repayments

Insurance appeals to people’s feelings about their family and their wish to protect them

Community finance, like cooperatives or savings circles, draw upon communal and family sentiments

Microfinance leverages social obligation to persuade people to repay their loans

But while marketing has used emotions heavily (advertising, letters and notices), until recently financial services have rarely been designed with customers’ emotions in mind.

Today, however, there are an increasing number of financial tools on the market that factor emotions in. Some explicitly ask users to think about their emotions, while others are designed with the awareness that emotions are part of the decision-making process. They tend to draw heavily on behavioural research, and use things like nudging or gamification to prompt people to learn.

Dreams focuses on personal goals more than on numbers.

Dreams

This financial management app helps users save, invest and pay off debt. Founded in 2014, the app is currently available in Sweden and Norway, but Dreams are also a B2B2C company and are going live in Ukraine with USB, a subsidiary to BNP.

According to their website, the app is intended to help people feel good about their money and reduce their stress. Dreams draws upon behavioural research that shows that people find personal goals more emotionally appealing than numbers. Founder and Chief Scientific Officer Elin Helander told us:

We want to take human emotions, which are often seen as a weakness, and turn them into a strength. By making money emotional and your savings goal emotional it’s easier to stay motivated and focused on your savings.

As the image above shows, the app’s design and marketing very much emphasise users’ emotional lives and relationships with others. In the interface, the most prominent information is the goal name (e.g. “For Ella <3”) and the user is able to include a photo that reflects their goal. The coloured band around the photo shows progress towards meeting the goal visually rather than numerically. The numerical goal is also written below the goal title, but is far less prominent than the other features.

Above all, Dreams emphasises that putting your emotions aside is unrealistic. As Elin puts it:

It’s still a common misconception in finance that rational decisions is opposite to emotional decisions. What people don’t know is that there is no such thing as a rational decision where your emotions are not involved. Our emotions are always driving our behaviour and decisions. Think about it, can you come up with one moment in life where your emotions are not present?

There is no doubt that this simple tool to connect financial savings with your short-term life goals appeals to customers who are tired of being told to act rationally.

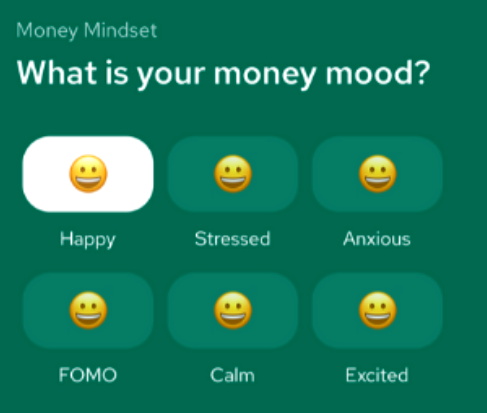

Nav.it's app allows you to rate and record your money mood to build a picture of your relationship with your finances.

Navi-it

Nav.it is a money management app for women in the USA. The company was founded in 2019 by CEO Erin Papworth and boasts an all-women executive team. They partner with financial planning, investment and insurance companies to offer a bundle of services to women.

An interesting feature of the app is its focus on wellbeing and mental health. As well as a wealth health check for premium users, all users can access a feature called “Money Mood” where they rate their attitude to money each day. Users are asked, “What is your money mood?” and can choose one of six answers: happy, stressed, anxious, FOMO, calm or excited. Then they are asked why they are feeling this way, choosing from financial causes (bills, income) and lifestyle causes (family, work, life, friends).

Collecting customers feelings about money is entirely new, and it will be interesting to follow how this information is integrated into future services.

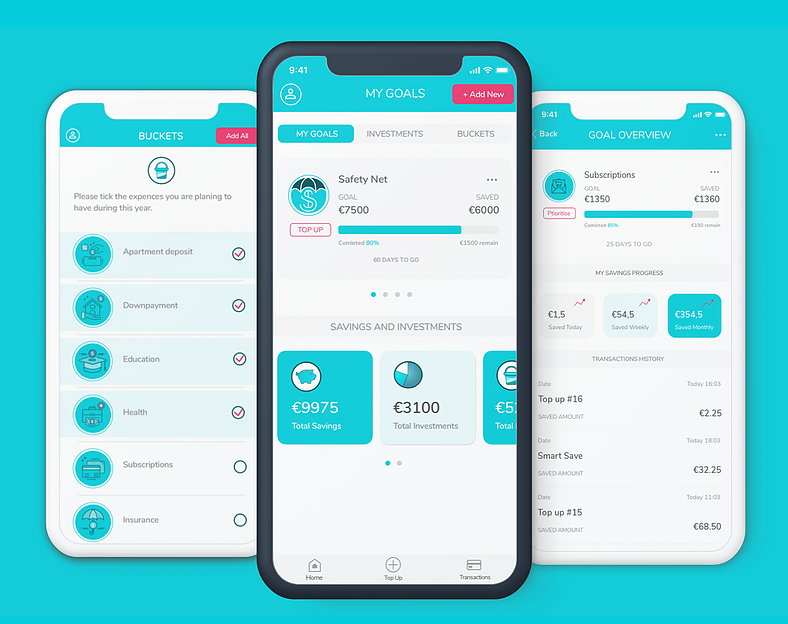

Limitless focuses on financial wellbeing for employees.

Limitless

Limitless is a financial wellbeing app for employees, targeted especially at millennials. Like Dreams they focus on goals, but they put more emphasis on covering everyday needs and building a safety net.

The app helps users to save and invest by moving money from their accounts in “small, unnoticeable bits”. Limitless promise that “You don’t need to sacrifice living in the present to build savings for your future.” This ethos very much taps into the realities of the lives of many young people, often burdened with education debt and just starting out on their career. They want to enjoy their lives, but feel anxious about the future.

The stand out feature of Limitless is the connection between (small) savings and investments. Until not so long ago investing often required a lot of knowledge or the funds to pay a financial adviser. Now apps like Limitless are levelling the playing field, allowing a far wider range of people to get into investing with small sums. And most importantly: they lower the emotional barriers that stand in the way.

***

These are just a few examples of financial services designed to take account of feelings. It is still early days, and we would love to know more about how companies are approaching emotions from a design perspective. What research does your company carry out? How are customers involved in the design process? And are there ways we can engage with feelings that we haven’t even imagined yet?